In January the Labor Department’s consumer price index rose by much more than expected. According to the data released on Tuesday, consumer prices increased by 0.5 percent in January and 6.4 percent annually. The high increase in inflation could also lead to the Federal Reserve further increasing already-high interest rates.

Core inflation, which does not include volatile prices such as food and energy, was at 0.4 percent on a month-to-month basis and 5.6 percent annually. Annual inflation has slowed down and is still declining when compared to its record high of 9.1 percent in June. Despite this, the monthly price growth increased by 0.1 percent between January and December, while food prices increased by 0.5 percent.

Housing costs also rose by 0.7 percent.

The annual inflation figure was also higher than the one that analysts had been expecting and could lead to another increase in the interest rates in order for the economy to slow down. An increase in interest rates could also help curb demand for goods and services.

Earlier this month, the Fed had its smallest rate increase since March 2022, when inflation appeared to be slowing down. However, depending on how prices reach, an additional hike might be necessary for the Fed’s 2 percent inflation target to be hit.

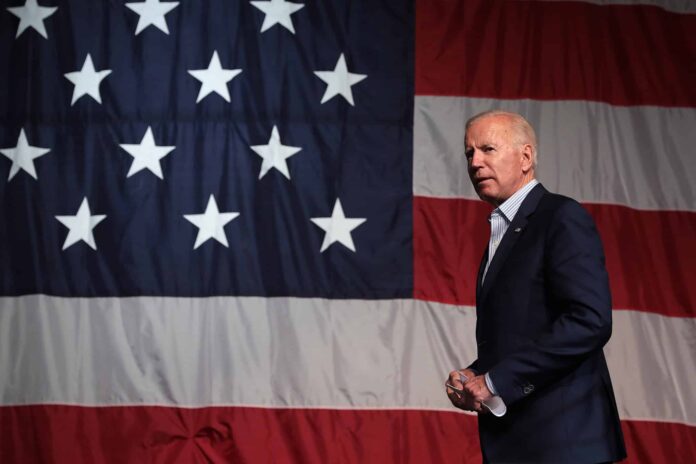

Since last year grocery prices have increased by 11.3 percent, energy prices have gone up by 8.7 percent and housing costs have gone up by 7.9 percent. The effects of these increases have been felt by the majority of American households, regardless of their financial stability. Will Biden ever manage to turn things around?